karpatkey governance newsletter: January 2025

Your essential guide to DAO governance proposals, initiatives and innovation

Hello, community!

Best Wishes to You for a Fantastic 2025.

As we step into the New Year, we at karpatkey have been delighted to see contributors from every corner of the DeFi industry returning from holidays with a renewed sense of vigour and resolve. In our work supporting many leading DAOs, we can already see the early traces of the innovation and ambition that set the tone for a fantastic year.

In this edition, we dive into the onslaught of new proposals that emerged in January, reflect on our own governance contributions in 2024, and review the agenda for the coming month.

Let’s get started! 🟢

Headline: GHO Forth & Conquer

It’s hard to deny that Aave was one of the EVM-universe’s biggest winners in 2024. Value locked in the protocol tripled to over $20 billion, revenue lept up to $389 million, and the pace of integrations and expansions accelerated. You might be forgiven for thinking you’ve already missed all the alpha. 😅

Well fear not; Aave is far from done. A selection of recent developments show how the DAO’s decentralized stablecoin - GHO - is preparing to steal the show:

In July, Aave Labs announced GHO’s first crosschain expansion to Arbitrum, signalling the DAO’s growth plans.

Following up in October, ACI proposed the deployment of GHO on Base.

Next, our team at karpatkey proposed an expansion to Gnosis Chain in December.

Also in December, Stani teased a new role for GHO as the gas token of upcoming Lens Chain, a sister project to Aave.

With karpatkey’s mandate for Gnosis Chain now secured, and the Base deployment moving forwards, 2025 is going to be filled with new and innovative opportunities for GHO users. Our proposal features a new $5 million Aave treasury to support GHO activities and liquidity on Gnosis Chain, strategic integrations and deployments across various new protocols, and even the development of a brand new sGHO Vault—which will deliver native yield to users by bridging staking rewards from Aave’s Merit Program automatically (similar to the Gnosis sDAI).

That’s a lot of opportunities coming up from a DAO that’s already got the wind behind its sails. We can’t wait to follow along as Aave moves from strength to strength in 2025.

👻 Read our full plans for GHO on Gnosis Chain

Key Topics & Proposals

Arbitrum: Leading the Charge

The Arbitrum DAO continues to blaze the trail in demonstrating how decentralised organisations pioneer innovation across our industry. In January, two particularly interesting proposals were ratified in public governance:

First, Arbitrum DAO approved the activation of a new “Bounded Liquidity Delay Protocol” (BoLD), which upgrades the existing dispute protocol on Arbitrum chains. As “optimistic” rollups, settlement on Arbitrum chains relies on a clear mechanism to dispute any wayward transactions. BoLD improves on the existing dispute process by making it permissionless, meaning bound by strict pre-formulated rules without involving any centralised entity. The adoption of BoLD is a key step toward becoming a Stage 2 Ethereum rollup.

Second, the DAO’s Stable Endowment Program (STEP) 2.0 passed on Snapshot, continuing efforts to diversify the Arbitrum treasury with real-world assets (RWAs). This new phase aims to build on that foundation, ensuring greater financial stability for the ecosystem. karpatkey was honoured to serve as a committee member in the first STEP cohort, and we’re excited to see how phase two can double down on the program’s successes in delivering real-world yields onchain.

We were pleased to support both of these crucial proposals, as well as Arbitrum’s broader vision for the future of blockchains and Ethereum more generally.

🔗 BoLD Proposal | Read the STEP proposal on Snapshot

CoW: Core Treasury Team Proposal

In January, the CoW DAO Core Treasury team shared an ambitious new proposal to expand its remit. Beyond adding more funding for its existing work through to 2028, the proposal draws attention to new areas for growth, including:

funding to support novel development work to grow CoW’s product lineup

an additional mandate to pursue strategic partnerships and integrations

an allocation for opportunistic market awareness activities

a fund to support the listing and liquidity of COW across centralised trading venues

As a member of the Core Treasury team, karpatkey was pleased to support the scoping and planning for this extended mandate. We look forward to continuing our work supporting innovation at CoW DAO in the course of 2025.

Lido: Structural Innovation

Lido DAO has been focused on revolutionising the way that DAOs operate through traditional legal entities. In partnership with MetaLeX and founder Gabriel Shapiro, Lido has been working to implement DAO-adjacent “cybernetic organizations” (BORGs) since August last year.

BORGs are a novel hybrid design, which takes advantage of the beneficiary-less Cayman Islands foundation structure to form a cleverly-designed entity that’s empowered to deliver the will of a DAO. BORGS feature strict controls on both a technical (smart contract) and legal (corporate structure) level to preserve the rights of DAO members. Lido DAO has recently been experimenting with this structure for its new ecosystem-aligned growth initiative — the “Lido Alliance”.

This latest proposal takes advantage of prior learnings to create a new Lido Labs BORG, to help with administering relationships between the DAO and its contributors, and managing both sides’ liability. If the Alliance BORG was the proof of concept, January’s proposal is the green light for mass production! It feels like BORG may be the acronym to watch in 2025…

🏛️ Learn more about the proposed new structure

ENS: Endowment Expansion & Adjustments

January was a big month for the ENS DAO and its Endowment, with significant proposals to iterate on their existing formula. karpatkey has stewarded two new proposals through the DAO’s governance:

First, we proposed expanding the ENS Endowment by a further 5,000 ETH in a third funding tranche. The goal is to reinforce the DAO’s long-term strategy for financial self-sufficiency by accelerating the movement to actively manage the DAO’s assets. The proposal also updates payment configurations to improve the efficiency of the Endowment’s operations.

Second, and to replenish the DAO’s operating reserves, we proposed swapping 6,000 ETH (~$20.4M) into USDC via Cow’s “time-weighted average price” (TWAP) mechanism. This will ensure a further 12 months of funding for key DAO expenses, including ENS Labs, service providers, and the DAO’s Working Groups. The structured approach balances immediate liquidity needs with a three-month gradual sell-off to minimise market impact.

🗳️ Endowment Proposal | Swap Proposal

Uniswap: Nerite x UNI Pilot Program

AlphaGrowth’s recent Request For Comment to the Uniswap DAO proposes to add utility to the UNI token through an integration with a new collateralised debt protocol - Nerite. As a member of the Uniswap Treasury Working Group (UTWG), karpatkey was pleased to get stuck into the discussions.

On the one hand, this proposal reflects an increasingly-active and mobilised Uniswap DAO working to build utility on top of its UNI governance token. But on the other hand, this proposal raises fundamental questions about the best (or most-appropriate) means of deploying the DAO’s assets, in pursuit of growth and the attainment of its goals.

We were pleased to share reflective feedback on the forum, building on our experience from the UTWG and working with other DAOs. karpatkey generally favours an approach where growth initiatives are executed as part of a wider, cohesive strategy. We also warned about the perils of pushing lots of smaller, tactical decisions to the DAO’s delegates, who may lack both the expertise and bandwidth to weigh in on every topic.

We look forward to engaging with and supporting future growth initiatives within Uniswap DAO.

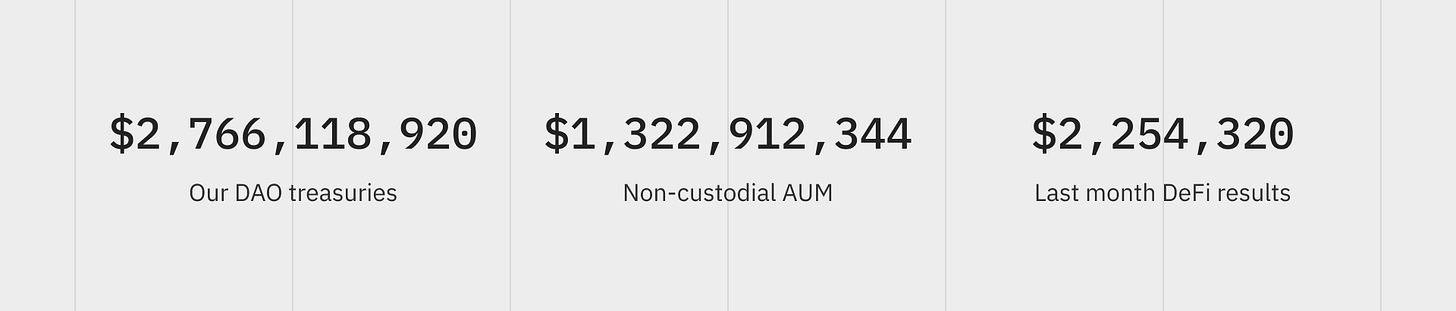

At a Glance: The DeFi Treasury Network

Check out the latest metrics showcasing karpatkey’s impact across our network of partner DAOs.

Upcoming Events

📍 Consensus, Hong Kong | 🗓️ February 18 - February 20

If you're attending and would like to connect with someone from our team, watch out for Simo, Jy and Goncalo in Hong Kong.

📍 ETH Denver, USA | 🗓️ February 23 - March 2

On 26 February, we’ll be participating in Messari’s Protocol Service Summit at the Denver Events Center. Jack will be presenting on the state of DeFi treasury management and how active non-custodial management is shaping the industry.

For those looking to learn more about our governance work, karpatkey’s Head of Governance, Coltron, will be around throughout the week.

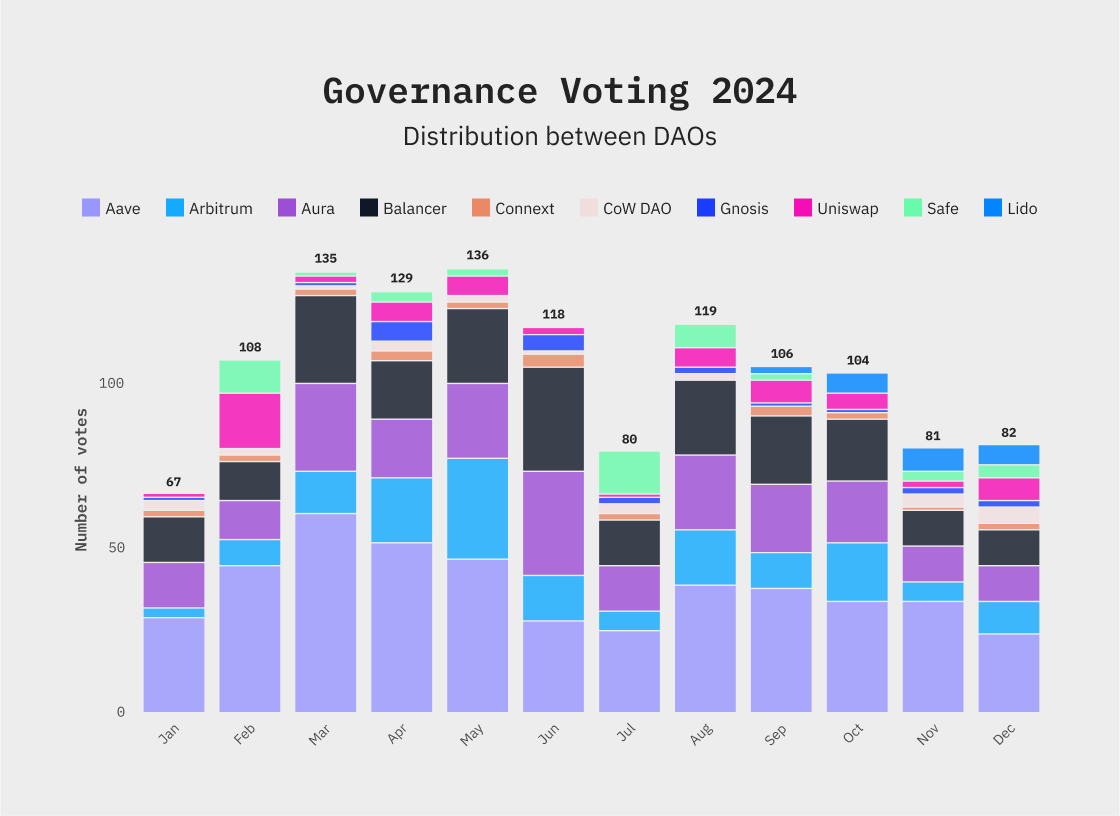

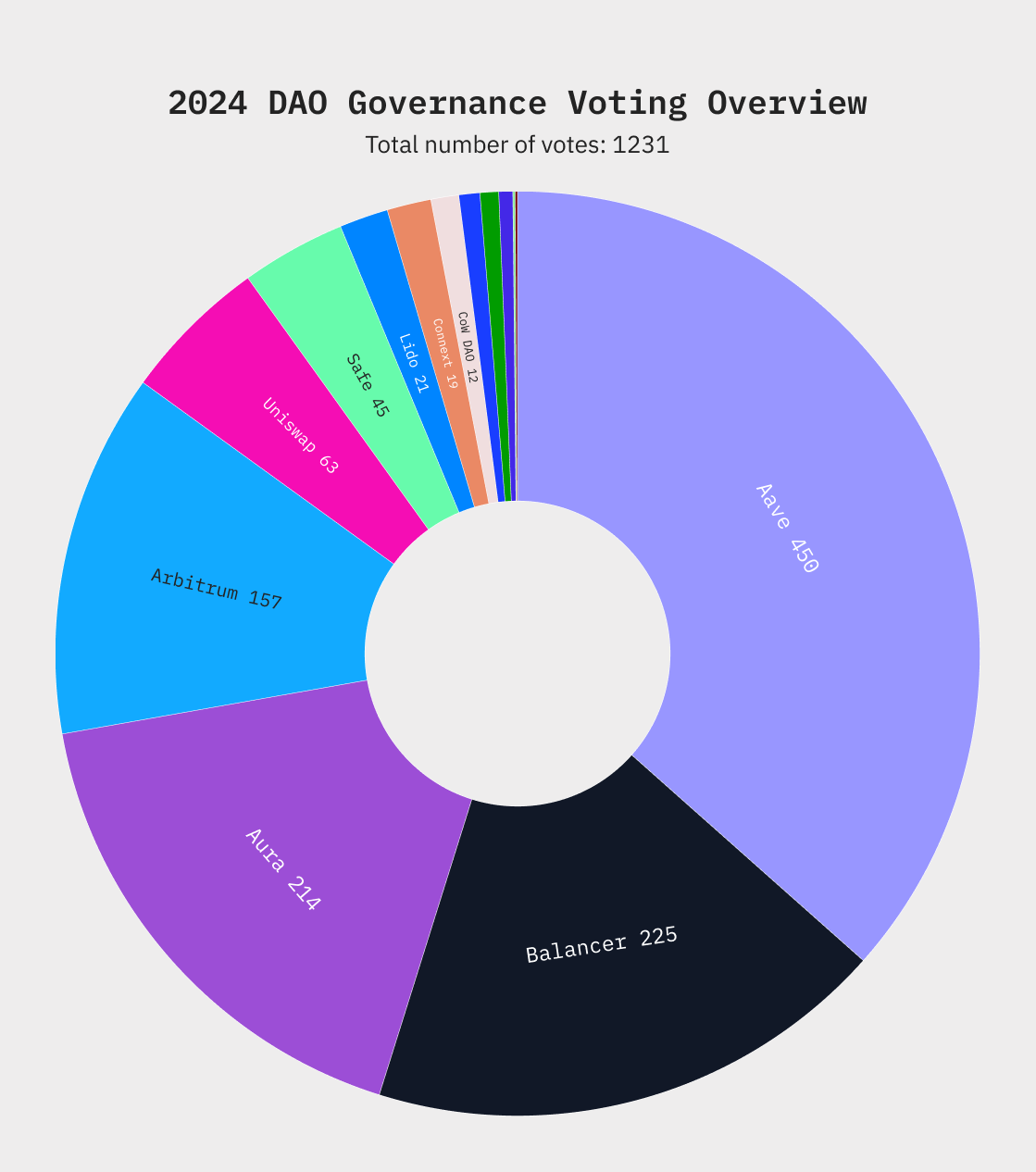

New Year Reflections

With 2024 now firmly in the rear-view mirror, the team at karpatkey have been reflecting on the progress of our governance efforts throughout the last 12 months.

We’re honoured to have had the privilege of stewarding and supporting governance efforts across so many leading DAOs, and to have participated in over 1,200 governance proposals. We served on committees and working groups, submitted research reports, and provided critical feedback in difficult conversations. And across so many distinctive and vibrant DAOs, we’re pleased to have played a small role in helping to make DeFi better, safer and more accessible for everyone.

We owe our sincerest thanks to all the communities that trusted us and welcomed our contributions in 2024. And we’re pleased to share these brief visualisations of our progress, together with a firm commitment to deliver ever-greater participation in 2025.

That’s it from us for January! But already, it’s safe to say that there’s going to be a lot more to cover in 2025. Subscribe to stay connected with us, as we navigate the flourishing universe of DeFi governance. We’re only just getting started!

Think that you too would like to devote yourself to stewarding the organisations at the heart of DeFi? Amazing! Take a look at our open positions, or connect with us on social media to learn more.

Until next time! 👋